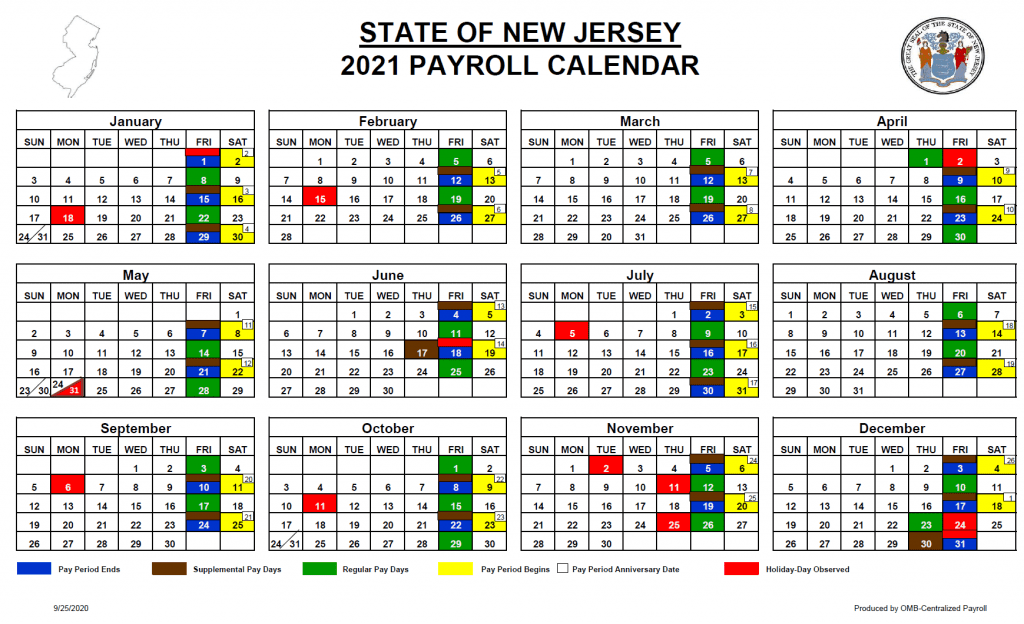

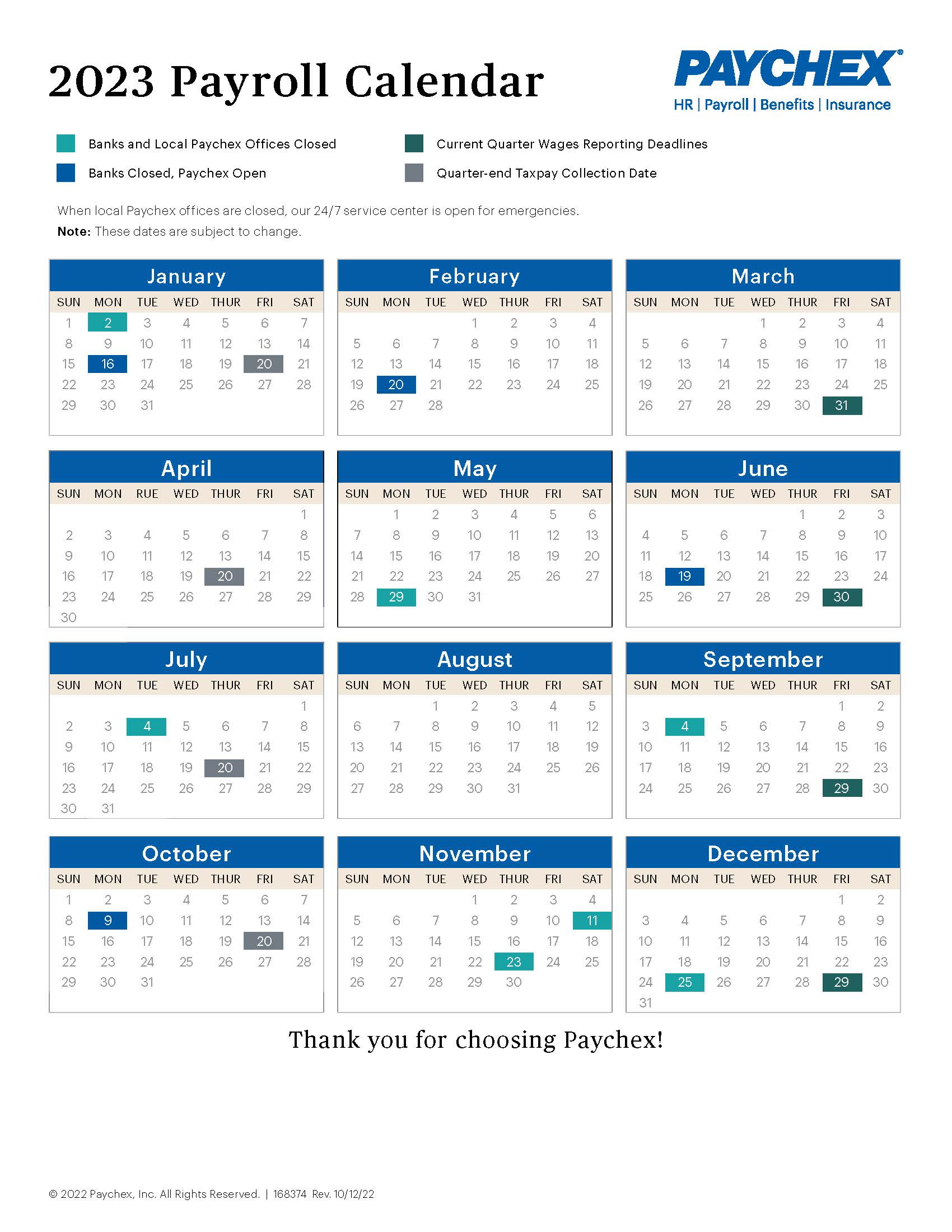

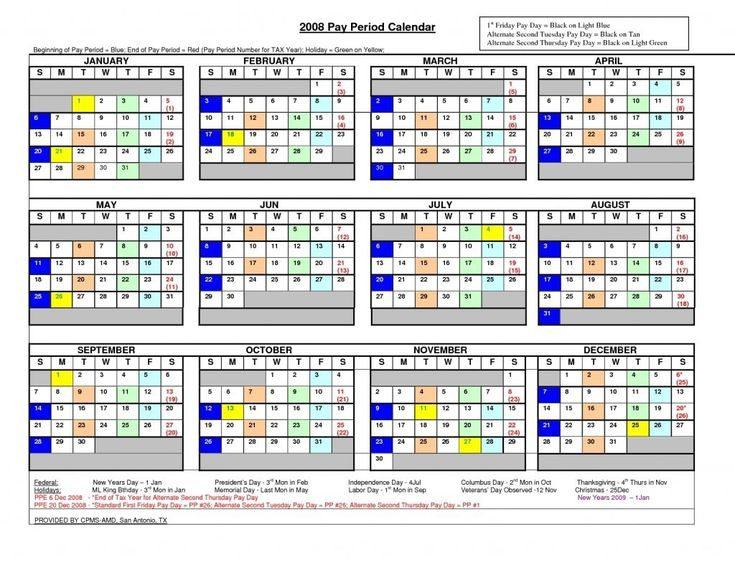

Nj State Employee Payroll Calendar 2024. Schedule of pay periods, proof due dates, pay days. New jersey state payroll deductions in 2024:

This page contains a calendar of all 2024 state holidays for new. Rates for employers and employees;

The 11.8% Tax Rate Applies To Individuals With Taxable Income Over.

4 5 6 7 8 9 10.

Rates For Employers And Employees;

State of new jersey payroll calendar 2024 | get and print state of new jersey payroll calendar for 2024.

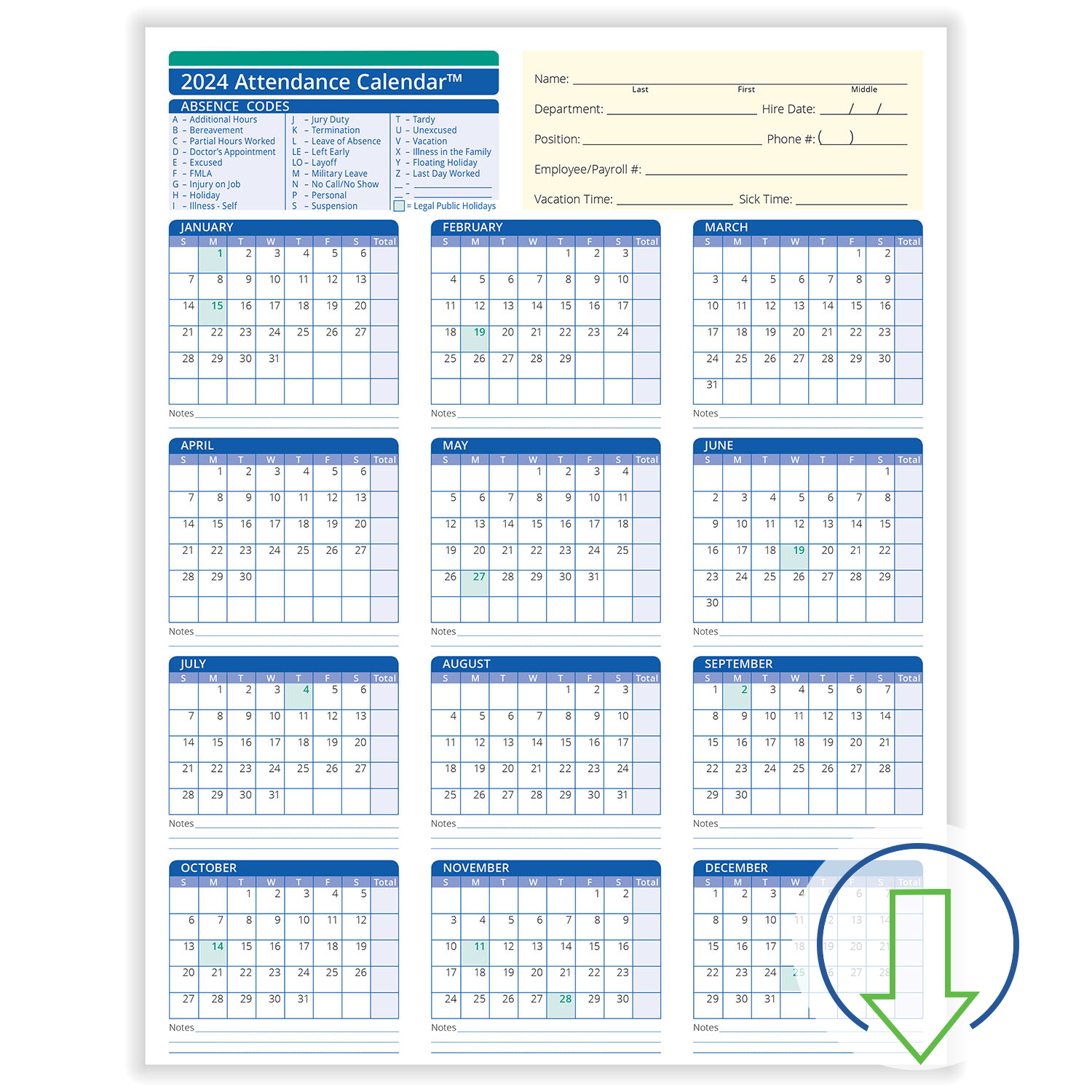

Days Paid By Employee Type.

Images References :

Source: payrollcalendar.net

Source: payrollcalendar.net

State of New Jersey Payroll Calendar 2024 2024 Payroll Calendar, Calendar years 2010 through 2023. Days paid by employee type.

Source: calendar.udlvirtual.edu.pe

Source: calendar.udlvirtual.edu.pe

2024 Printable Payroll Calendar 2024 CALENDAR PRINTABLE, Days paid by employee type. Vehicle, rather than employee mobility, is necessary to perform the duties of the position.

Source: sydneyzanne.pages.dev

Source: sydneyzanne.pages.dev

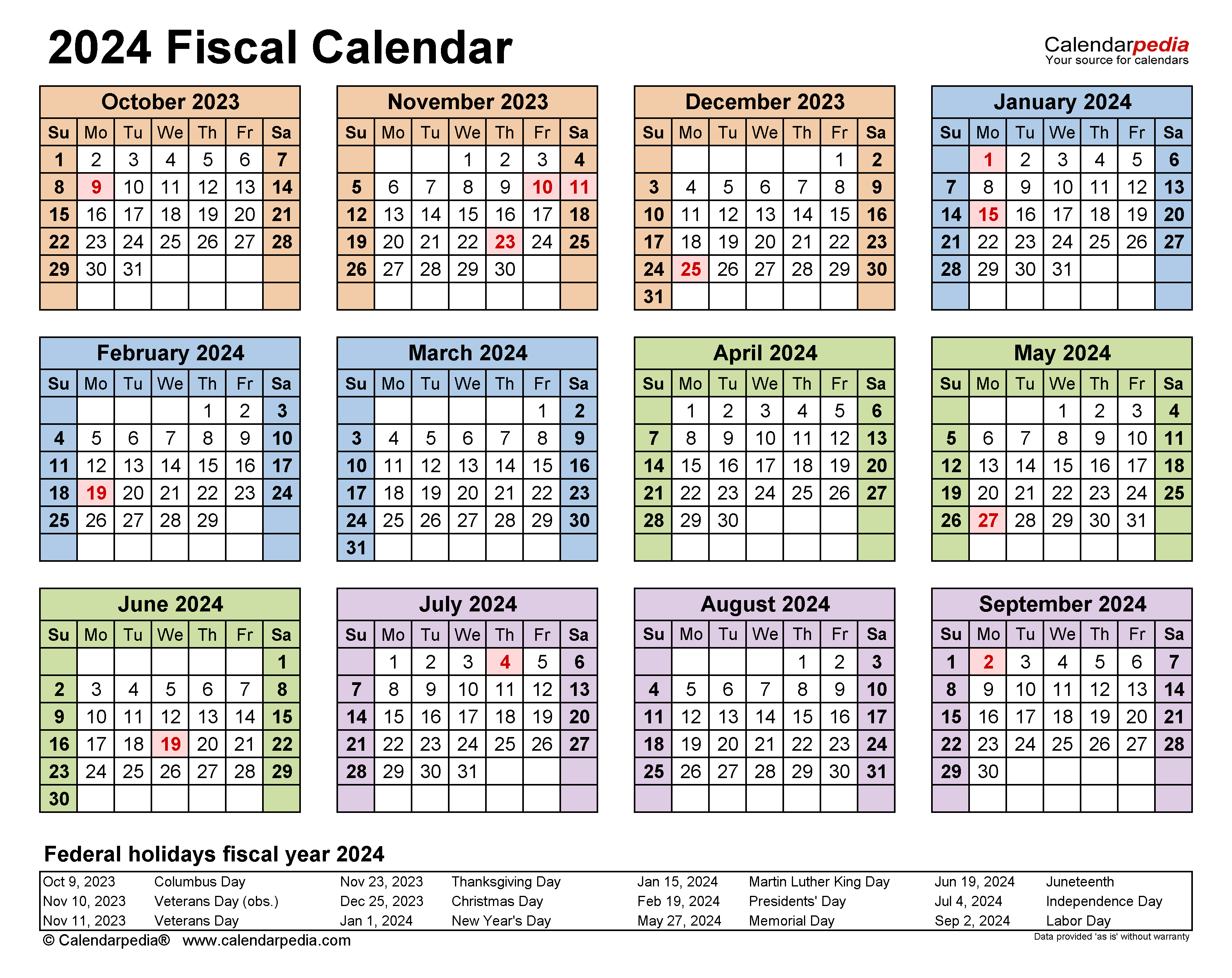

26 Week Pay Period Calendar 2024 Fiscal Blank 2024 Calendar, State of new jersey 2024 payroll calendar. New jersey department of state.

Source: www.2024calendar.net

Source: www.2024calendar.net

2024 Biweekly Pay Calendar 2024 Calendar Printable, Global » united states » new jersey. 4 5 6 7 8 9 10.

Source: payrollcalendar.net

Source: payrollcalendar.net

Pay Period Calendar 2024 2024 Payroll Calendar, Use the calendar to check your next payment schedule. New jersey gross income tax.

Source: calendar2024monthlyfreezyq.pages.dev

Source: calendar2024monthlyfreezyq.pages.dev

2024 Employee Attendance Calendar Printable Free Free Free Printable, Global » united states » new jersey. New jersey state holidays 2024.

Source: mareahzhertha.pages.dev

Source: mareahzhertha.pages.dev

Payroll Calendar 2024 Template Berry Celinda, Starting (yyyy) ending (yyyy) last name: A monthly payroll calendar is where you pay your employees at the beginning or end of every.

Source: blog.mozilla.com.tw

Source: blog.mozilla.com.tw

2024 Federal Pay Period Calendar, Global » united states » new jersey. Days paid by employee type.

Source: carlotazmavis.pages.dev

Source: carlotazmavis.pages.dev

Uconn Payroll Calendar 2023 Everything You Need To Know 2023 Holiday, New jersey state holidays 2024. The unemployment tax rate for employees in 2024 is 0.425% new jersey unemployment.

Source: www.2024calendar.net

Source: www.2024calendar.net

Federal Government Pay Period Calendar 2024 2024 Calendar Printable, State of new jersey 2022 payroll calendar. New jersey gross income tax.

2024 Payroll Calendars | Nc Osc.

Calendar years 2010 through 2023.

M T W T F S.

Current as of august 29, 2023.